02.17.2022 | Firm Post

As a follow-up to Hoge Fenton’s February 11, 2022 article regarding the return of California COVID-19 Supplemental Paid Sick Leave, the State has now published a required notice for employers to post in the workplace and to email to remote employees.

The notice can be found here, and it is also available in Spanish here.

The new COVID sick pay law requires all covered employers (those with 26 or more employees) to post this notice and email it to remote employees, by February 19, 2022.

Our Employment Law Group has extensive experience advising employers on California’s SPSL laws and other issues pertaining to the COVID-19 pandemic. For more information and to contact Hoge Fenton’s Employment Law Group, click here.

02.11.2022 | Firm Post

On February 9, 2022, Governor Gavin Newsom revived California’s COVID-19 Supplemental Paid Sick Leave (“SPSL”). Employers may recall that California had a similar law last year, but it expired in September 2021. This new SPSL law goes into effect on February 19, 2022, but it will be applied retroactively to January 1, 2022, and it will expire on September 30, 2022.

Covered Employers

SPSL applies to employers with 26 or more employees.

Covered Employees

SPSL applies to employees who are unable to work or telework due to one of the qualifying reasons listed below.

Qualifying Reasons For SPSL

A covered employee is entitled to 40 hours of SPSL if they are:

- Subject to quarantine or isolation due to COVID-19 as defined by an order or guidance of the CDPH, CDC, or a local public health officer. If the employee is subject to more than one order or guidance, the employee is allowed to use SPSL for the minimum quarantine or isolation period under the order or guidance that provides for the longest minimum period; or

- Advised by a health care provider to isolate or quarantine due to COVID-19; or

- Attending a COVID-19 vaccine or vaccine booster appointment for themselves or a family member (employers can limit this to 24 hours unless the employee provides medical documentation that the employee or family member is still experiencing symptoms related to the vaccine or booster); or

- Experiencing COVID-19 symptoms; or

- Caring for a family member experiencing symptoms, related to a COVID-19 vaccine or vaccine booster; or

- Caring for a family member who is subject to an order or guidance, or is required to isolate or quarantine as described above;

- Caring for a child, whose school or place of care is closed or otherwise unavailable for reasons related to COVID-19 on the premises.

A covered employee is entitled to an additional 40 hours of SPSL if the employee, or a family member for whom the employee is providing care, tests positive for COVID-19. The employer can require proof of a positive test.

Calculation of Leave Amount Based on Work Hours

Employees who work full time or were scheduled to work, on average, at least 40 hours per week in the 2 weeks prior to taking SPSL, are entitled to up to 80 hours of paid time off. Employees who work fewer or variable hours are subject to a different calculation that is based on the number of hours they typically work. Employers should contact legal counsel for guidance on how to calculate SPSL for employees who are part-time or work variable hours.

Retroactive Application and Credit

If, prior to the SPSL going into effect, the employer already paid employees an amount equal to or greater than the amount employees would have been entitled if SPSL was in existence as of January 1, 2022, then upon request of an employee, the employee can be credited for any leave hours used for COVID-specific leave purposes, and the employer can be credited for providing those hours pursuant to SPSL.

If the employer did not already pay employees an amount equal to or greater than the amount employees would have been entitled if SPSL was in existence as of January 1, 2022, then upon request of an employee, the employer must provide the employee a retroactive payment for the SPSL.

No Overlap With Cal/OSHA Exclusion Pay

SPSL is separate from exclusion pay required under Cal/OSHA’s Emergency Temporary Standards (ETS) for employees exposed to COVID-19 in the workplace. Therefore, the SPSL law does not credit employers for exclusion pay that is required by the ETS. Further, employers cannot require employees to exhaust SPSL before receiving exclusion pay under the ETS.

SPSL Maximum Pay

The amount of required SPSL pay is capped at $511 per day and $5,110 total per employee unless these amounts are increased by federal law (which is not currently expected)

SPSL Takes Priority Over Other Leaves

Employers cannot require employees to use any other type of leave before requesting SPSL, including, but not limited to, California Paid Sick Leave.

Requirement to Identify SPSL Usage on Wage Statements

Employers must list the amount of SPSL that has been used on employees’ paystubs. If an employee has not yet used any leave, their wage statement must reflect that “0” hours have been used.

Requirement to Provide Written Notice to Employees

Employers are required to post notice of employees’ SPSL rights. The Labor Commissioner intends to provide a sample notice within seven days of the enactment of the law – by February 16, 2022. Employers should provide the notice via email to remote employees.

Hoge Fenton’s Employment Law Group has extensive experience advising employers on California’s SPSL laws and other issues pertaining to the COVID-19 pandemic. For more information and to contact Hoge Fenton’s Employment Law Group, click here.

06.17.2021 | Firm Post

Thank you for joining us for our Reopening California – What Employers Need to Know webinar. Click below to view the webinar recording with Employment Law Attorneys Sarju Naran and Jenn Protas. A copy of the presentation can be downloaded here.

For more information or resources regarding COVID-related laws applicable to employers and/or employees, please refer to Hoge Fenton’s Employment Law Group’s resource page, or feel free to contact a member of the Employment Law Group.

Our Employment Law Team

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Maysa Saeed is an associate attorney in Hoge Fenton’s Employment Law Practice Group. Her practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s litigation experience provides her with invaluable insight and perspective when advocating and advising clients to resolve or prevent legal disputes. |

This webinar is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2021 Hoge Fenton

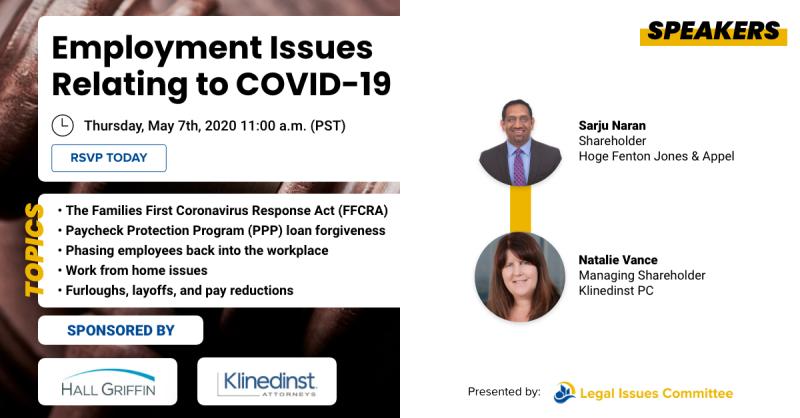

06.03. 2021 | Speaking Engagements & Firm Events

Effective June 15, 2021, the California Department of Public Health (CDPH) has announced the state will advance beyond the Blueprint for a Safer Economy, allowing businesses to return to normal operations with “common-sense risk reduction measures.”

In parallel with the state reopening, Cal/OSHA is in the process of finalizing its revised Emergency Temporary Standards (ETS), which will dictate COVID-related restrictions and requirements in the workplace.

Join us for an informative panel discussion on Wednesday, June 16, 2021, from 3:00 to 4:00 p.m. as Hoge Fenton’s Employment Law team will explain the new legal guidelines for California employers.

Our Employment Law Team

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Maysa Saeed is an associate attorney in Hoge Fenton’s Employment Law Practice Group. Her practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s litigation experience provides her with invaluable insight and perspective when advocating and advising clients to resolve or prevent legal disputes. |

This webinar is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2021 Hoge Fenton

05.25.2021 | Firm Post

On Tuesday, May 18, Santa Clara County moved to the Yellow Tier of California’s Blueprint for a Safer Economy. In doing so, the County Health Officer issued a new order (with accompanying FAQs) establishing focused safety measures to protect the community from COVID-19 (“the Order”). Among other things, the Order no longer requires businesses to maximize teleworking, eliminates local rules related to capacity, and eliminates the requirement that businesses submit Social Distancing Protocols to the County Public Health Department. However, state rules, including the Cal/OSHA’s COVID-19 Emergency Temporary Standards1, still apply.

Making news is the unexpected requirements by the County that businesses ascertain the vaccination status of all personnel, including employees, contractors, sub-contractors, independent contractors, vendors, volunteers, and other individuals who regularly provide services onsite at the request of the business. The Order requires businesses to ascertain vaccination status of personnel within 14 days of the effective date of the Order—by June 1. Thereafter, businesses must obtain updated vaccination status for all personnel who were not fully vaccinated every 14 days.

Unvaccinated personnel and personnel who decline to provide vaccination status must comply with the Mandatory Directive on Use of Face Coverings and all applicable provisions of the Health Officer’s Mandatory Directive on Unvaccinated Personnel. As such, unvaccinated personnel must continue to wear face coverings at the worksite, must be excluded from the workplace if they’ve been in “close contact” to a confirmed case or have been confirmed to have COVID-19, and must be provided with information on how to get vaccinated2. The County provides a compliant information sheet that businesses can use for this purpose. The Health Officer also urges businesses to require unvaccinated personnel to obtain weekly PCR testing for COVID-19 or daily antigen testing with COVID PCR confirmation of any positives.

Businesses must maintain a written record of their efforts to ascertain vaccination status of their personnel by either (1) confirming their visual review of vaccination documentation, or (2) gathering self-certifications from personnel. The County provides a sample Certification Form that businesses can use to ascertain vaccination status. The form gives employees the option to decline to provide that information, in which case employers must treat such employees as unvaccinated personnel. Businesses must treat these records as confidential medical records.

Failure to comply may result in fines up to $5,000 per violation per day.

Although this requirement is currently a Santa Clara County requirement only (i.e., neither the state nor any other county in the Bay Area has imposed requirements to ascertain vaccination status of personnel), we have seen throughout the pandemic that other counties are likely to follow suit.

Even without a mandate to do so, many employers may choose to ascertain vaccination status of their employees and contractors, and doing so is permissible. It is not a violation of the Health Insurance Portability and Accountability Act (HIPAA), the Americans with Disabilities Act (ADA), or the California Fair Employment and Housing Act (FEHA) to request vaccination status or require proof of vaccination. That said, employers should not ask why employees decline to get vaccinated or share vaccination status. Asking employees why they are not vaccinated or why they decline to share their vaccination status could elicit disability-related information, and, as such, those inquiries are not permitted by the ADA or FEHA. Employee vaccination status should be treated as confidential.

Of course, some businesses are concerned about treating vaccinated and unvaccinated employees differently. Such differential treatment is not based on a protected class (so long as you are treating all unvaccinated personnel equally) and is based on employers’ efforts to keep their employees and the public safe. Therefore, it is permissible to treat vaccinated employees differently if following federal, state, and local guidance in doing so. That said, even when no longer required to enforce mask mandates by state or local laws, businesses are permitted to continue to require all employees to wear face coverings and maintain social distance while at the worksite, regardless of vaccination status.

For more information or resources regarding COVID-related laws applicable to employers and/or employees, please refer to Hoge Fenton’s Employment Law Group’s resource page, or contact a member of the Employment Law Group.

1Cal/OSHA was set to vote on new rules in workplace settings on May 20, but the vote was postponed to June 3. While the state has indicated its intention to adopt the new CDC guidance to allow fully vaccinated Californians to go without face coverings in most indoor settings outside of workplaces when the state fully re-opens (planned tentatively for June 15), the Cal/OSHA Emergency Temporary Standards are still in effect for workplace settings until changed by Cal/OSHA.

2Until the Cal/OSHA and the California Department of Public Health modify requirements, vaccinated personnel must also still wear face coverings in the workplace.

Our Employment Law Group

|

Jenn Protas (she/her) helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Sarju Naran (he/him) is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Maysa Saeed (she/her) is an associate attorney whose practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s prior legal experience also includes defending insurance carriers in administrative trials before the Workers’ Compensation Appeals Boards in San Jose and Salinas. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2021 Hoge Fenton

03.29.2021 | Firm Post

On March 11, 2021, President Biden signed into law the American Rescue Plan Act of 2021 (“ARPA”). Among other things, the ARPA creates a federal subsidy covering 100% of COBRA premiums for certain employees and other qualified beneficiaries. COBRA premiums from April 1, 2021 through September 30, 2021 must now be paid by employers. Employers can be reimbursed through tax credits via their quarterly payroll tax filings.

What is COBRA?

The Consolidated Omnibus Budget Reconciliation Act (“COBRA”) gives eligible employees and their beneficiaries who lose their health benefits for qualifying reasons (such as job loss, reduced hours, or other life events) the right to choose to continue group health benefits provided by their group health plan for limited periods. These qualified individuals may be required to pay the entire premium for coverage up to 102% of the cost to the plan, which represents a huge increase in expenses for health benefits to individuals who are suddenly with less income. In the middle of the worst health pandemic in recent history, employees are losing their jobs or working fewer hours, and health benefits are more important than ever.

What is the COBRA Subsidy?

In recognition of the cost of COBRA premiums, the ARPA provides that “assistance eligible individuals” who timely enroll (either initially or during the special enrollment period) for COBRA coverage will be treated as having paid in full the amount of the COBRA premiums for eligible periods between April 1, 2021 and September 30, 2021 (“the Subsidy Period”). The ARPA does not extend the COBRA coverage period.

Who are “assistance eligible individuals?”

Assistance eligible individuals are those whose initial 18-month COBRA period (whether the individual initially elected COBRA coverage, did not elect COBRA coverage, or let their COBRA coverage lapse) includes some or all of the Subsidy Period and who (1) lost coverage under their employer’s health care plan due to a reduction of hours or involuntary termination (for reasons other than gross misconduct) and (2) elect COBRA continuation coverage—even if after receipt of notice of the subsidy. Employees who voluntarily terminated their employment are not eligible for the subsidy. An assistance eligible individual is no longer eligible for the subsidy upon (1) becoming eligible for other group health plan coverage or Medicare, (2) the expiration of the maximum COBRA period, or (3) the end of the Subsidy Period, whichever comes first.

Assistance eligible individuals during the Subsidy Period fall into one of three situations:

- Assistance eligible individuals who have already elected COBRA and are covered on April 1, 2021 do not need to do anything further to be covered by the subsidy.

- Eligible individuals who did not initially elect COBRA will be given a special enrollment period to elect coverage. This special enrollment period begins April 1 and ends 60 days after receipt of the COBRA subsidy notification. If these individuals elect COBRA coverage, the coverage will be retroactive to April 1, 2021 at no cost.

- Eligible individuals who let their COBRA coverage lapse but whose initial COBRA period extends beyond April 1, 2021 will be given a special enrollment period to elect coverage. This special enrollment period begins April 1 and ends 60 days after receipt of the COBRA subsidy notification. If these individuals elect COBRA coverage, the coverage will be retroactive to April 1, 2021 at no cost.

What must employers do?

Employers, or their benefits providers and third-party administrators, have some responsibilities, including the following:

- Employers should identify all assistance eligible individuals and provide required notices about the new benefit and the special enrollment period. The U.S. Department of Labor is working on model notices for these purposes.

- COBRA election notices for those eligible for the subsidy must include information related to the subsidies, among other information. Work with your benefits providers and third-party administrators to determine what specific information to include and to issue the notices.

- Individuals who are eligible for the special enrollment period must be provided notice of the opportunity to enroll (or re-enroll) by May 31, 2021.

- Assistance eligible individuals are entitled to notification of the subsidy termination date 15 to 45 days before the expiration.

- For assistance eligible individuals, employers must pay the COBRA premium owed during the Subsidy Period to a COBRA provider or plan administrator.

- Employers must also refund any premiums paid by employees during the Subsidy Period.

- Employers may then take a dollar-for-dollar tax credit on their quarterly payroll tax filings.

For more information or resources regarding COVID-related laws applicable to employers and/or employees, please refer to Hoge Fenton’s Employment Law Group’s resource page, or feel free to contact a member of the Employment Law Group.

Meet Our Employment Law Group

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Maysa Saeed is an associate attorney whose practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s prior legal experience also includes defending insurance carriers in administrative trials before the Workers’ Compensation Appeals Boards in San Jose and Salinas. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2021 Hoge Fenton

03.24.2021 | Firm Post

The only constant is change! California employers who received our recent article regarding paid sick leave under the Families First Coronavirus Response Act (FFCRA) being optional…hold that thought. Effective March 29, 2021, employers with more than 25 employees will be required to offer up to 80 hours of paid sick leave to California employees who are unable to work or telework due to certain reasons related to COVID-19. Importantly, this requirement will be retroactive to January 1, 2021, which means employees who have already taken time off in 2021 for a qualifying reason will be entitled to be paid for the time off by the next full pay period after they notify their employer of their request.

Employers are required to post a notice of this new benefit (emailing the notice to employees will also work). The California Labor Commissioner has published a model notice for this purpose, and it nicely sets forth the details and requirements of California’s new COVID-19 supplemental paid sick leave (CSPSL). Click here for a copy of the model notice.

Tip: Our recent article on the revamp of the FFCRA discussed that employers who provide paid sick leave can be reimbursed through federal tax credits. Since California is not reimbursing employers for providing supplemental paid sick leave, employers should claim reimbursement through tax credits under the FFCRA when employees take time off that qualifies for paid sick leave under both the FFCRA and California’s CSPSL.

Other Overlapping Laws: Employers with employees in San Jose should be mindful of the need to consider and coordinate sick leave requests under San Jose’s emergency paid sick leave ordinance as well as the FFCRA and California CSPSL. Click here for our January 8, 2021 article regarding San Jose’s ordinance. Several other cities and counties have similar local ordinances, so employers should be aware of where their employees perform their work and whether those locations have sick leave ordinances that also need to be considered and coordinated with the FFCRA and California CSPSL.

For more information or resources regarding COVID-19 Supplemental Paid Sick Leave or other COVID-related laws applicable to employers and/or employees, please refer to Hoge Fenton’s Employment Law Group’s resource page here, or feel free to email a member of the Employment Law Group.

Meet Our Employment Law Group

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Maysa Saeed is an associate attorney whose practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s prior legal experience also includes defending insurance carriers in administrative trials before the Workers’ Compensation Appeals Boards in San Jose and Salinas. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2021 Hoge Fenton

03.22.2021 | Firm Post

On Thursday, March 11, 2021, President Joe Biden signed into law the most recent COVID-19 relief package, the American Rescue Plan Act of 2021 (“ARPA”). The ARPA affords employer-provided benefits to employees and extends and modifies several of the provisions enacted in prior COVID-19 relief bills, including the Families First Coronavirus Response Act (“FFCRA”).

Background

Last year, the FFCRA required covered employers with 500 or fewer employees to provide eligible employees with paid sick leave and expanded family and medical leave for specified reasons related to COVID-19. That requirement expired on December 31, 2020, and was replaced by the 2021 Consolidated Appropriations Act (“CAA”), which permitted covered employers to continue receiving federal tax credits for allowing its employees to take unused FFCRA paid leave between January 1, 2021 through March 31, 2021.

How Has FFCRA Leave Changed?

Effective April 1, 2021, the ARPA extends the option for employers to voluntarily offer FFCRA paid leave to eligible employees through September 30, 2021, and to receive reimbursement for the pay through tax credits. The ARPA also modifies the FFCRA in a few ways.

New qualifying reasons: As of April 1, 2021, employers who choose to offer FFCRA leave, will need to permit employees to take paid leave for the following additional qualifying reasons: (1) receiving a COVID-19 vaccine; (2) recovering from any injury, disability, illness, or condition related to the COVID-19 vaccine; (3) seeking or awaiting the results of a COVID-19 test when the employee has been exposed to COVID-19 or the employer has requested the test. These new qualifying reasons will apply to both emergency paid sick leave (EPSL) and emergency family and medical leave (EFMLA). Under the original version of the FFCRA, EFMLA was only available for school or childcare issues.

New bank of EPSL time: For employees who previously used some or all of their FFCRA paid sick time, on April 1, 2021, the ARPA creates a new allotment of up to 80 hours (10 days) for qualifying EPSL). Please note, this new allotment only applies to EPSL. Employees who have used some or all of their EFMLA time prior to April 1, 2021 will not be afforded any additional allotment of EFMLA time.

All 12 weeks of EFMLA will be paid: The first two weeks of the 12-week period of leave under the EFMLA will no longer be unpaid. As a result, between EPSL and EFMLA, eligible employees may be able to take up to 14 weeks of paid time off for a qualifying reason, if their employer chooses to offer FFCRA leave (and assuming the employees have not previously exhausted their 12 weeks of EFMLA). Further, the prior cap on pay for EFMLA will increase from $10,000 to $12,000 (to account for the extra two weeks of pay). As before, employees will still be compensated at 2/3 of their regular rate of pay, up to a $200 daily cap for EFMLA.

No discrimination: The ARPA includes rules that will deny employers tax credits if they discriminate by offering leave: (1) in favor of highly compensated employees; (2) in favor of full-time employees; or (3) on the basis of employment tenure.

Beyond the FFCRA

As a reminder, while covered employers are no longer required to provide paid leave under the FFCRA, they should remain mindful of other paid and unpaid leave requirements under state, federal, and local laws.

For more information or resources regarding the FFCRA or other COVID-related laws applicable to employers and/or employees, please refer to Hoge Fenton’s Employment Law Group’s resource page (here), or feel free to contact a member of the Employment Law Group.

Meet Our Employment Law Group

|

Maysa Saeed is an associate attorney whose practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s prior legal experience also includes defending insurance carriers in administrative trials before the Workers’ Compensation Appeals Boards in San Jose and Salinas. |

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2021 Hoge Fenton

01.08.2021 | Firm Post

by Sarju Naran, Employment Law Group

On January 5, 2021, the San Jose City Council voted unanimously to extend the timeframe for employers to provide emergency paid sick leave benefits to San Jose employees for qualifying reasons pertaining to COVID-19. Click here for a copy of the new ordinance.

Employers may recall that the San Jose ordinance was first enacted on April 7, 2020, as a way to provide paid sick leave benefits to San Jose employees who were not eligible for federal paid sick leave benefits under the Families First Coronavirus Response Act (FFCRA). Shortly after the San Jose ordinance was enacted, California enacted a similar statewide COVID-19 supplemental paid sick leave for employees who were ineligible for benefits under the FFCRA. However, all three laws (the FFCRA, the California COVID-19 supplemental paid sick leave, and the San Jose ordinance) expired on December 31, 2020, rendering employees without any COVID-19 paid sick leave protections in 2021. With the COVID-19 crisis continuing to persist, the San Jose City Council has now voted to extend paid sick leave benefits for an additional 6 months, and to make the extension retroactive to January 1, 2021.

Key points of the new ordinance:

- All employees who perform at least 2 hours of work within the City of San Jose are eligible for paid sick leave for a qualifying reason, regardless of the company’s employee headcount (i.e., with the FFCRA expired, the ordinance is no longer aimed at companies with more than 500 employees or fewer than 50 employees)

- Qualifying reasons—The employee must be unable to work (i.e. employees who can work remotely are not eligible) for one of the following reasons:

- The employee is subject to a federal, state, or local quarantine or isolation order related to COVID-19

- The employee has been advised by a health care provider to self-quarantine due to concerns related to COVID-19

- The employee is experiencing symptoms of COVID-19 and seeking a medical diagnosis

- The employee is caring for an individual who is either: (1) to a subject federal, state, or local quarantine or isolation order related to COVID-19, or (2) has been advised by a health care provider to self-quarantine due to concerns related to COVID-19

- The employee is caring for a son or daughter of such employee if the school or place of care of the son or daughter has been closed, or the childcare provider of such son or daughter is unavailable, due to COVID-19 precautions

- Full-time employees are eligible for 80 hours of paid sick leave, to be used between April 2, 2020, and June 30, 2021. Part-time employees are eligible for pro-rated leave.

- Employees who take leave for themselves are entitled to their full regular pay, up to a maximum of $511 per day. Employees who take leave to care for another person are entitled to two-thirds of their regular pay, up to a maximum of $200 per day.

- Employees cannot be required to take other available paid time off first (e.g. vacation, PTO) before using paid sick leave under the ordinance.

- However, importantly, the ordinance does not apply to any company that provides paid personal leave that is at least equivalent to the paid sick time required under the ordinance. For example, because the ordinance provides full-time employees with 80 hours of leave between April 2, 2020, and June 30, 2021 (i.e. 15 months), if a company offers its full-time employees a combination of vacation accrual and sick time that equals at least 80 hours of paid time off over the course of 15 months, the company is not required to do anything further to comply with the San Jose ordinance. If a company offers its full-time employees less than 80 hours of paid personal leave over 15 months, the company needs to make up the shortfall with paid sick time under the ordinance (and as stated in the prior bullet point, the employee must be able to use the paid sick time first before using any other form of paid leave).

For more information or resources regarding COVID-related laws applicable to employers please refer to Hoge Fenton’s Employment Law Group’s resource page here, or feel free to contact a member of the Employment Law Group.

Meet Our Employment Law Group

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Maysa Saeed is an associate attorney whose practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s prior legal experience also includes defending insurance carriers in administrative trials before the Workers’ Compensation Appeals Boards in San Jose and Salinas. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2021 Hoge Fenton

12.28.2020 | Firm Post

by Maysa Saeed and Jenn Protas, Employment Law Group

On April 1, 2020, the United States Department of Labor (“Department”) announced the Emergency Paid Sick Leave Act and Emergency Family and Medical Leave Expansion Act, both part of the Families First Coronavirus Response Act (“FFCRA”). The FFCRA requires employers with 500 or fewer employees to provide their eligible employees with paid sick leave and expanded family and medical leave for specified reasons related to COVID-19. These paid leave provisions became operational on April 1, 2020 and are set to expire on December 31, 2020.

The FFCRA helps mitigate the effects of COVID-19 in the workplace by reimbursing covered employers with tax credits for the cost of providing employees with paid leave taken for specified reasons related to COVID-19. Covered employers qualify for dollar-for-dollar reimbursement through tax credits for all qualifying wages paid under the FFCRA, up to the appropriate per diem and aggregate payment caps. Applicable tax credits also extend to amounts paid or incurred to maintain health insurance coverage. As such, the FFCRA enables employers to keep their workers on their payroll, while at the same time ensuring that workers are not forced to choose between their paychecks and the public health measures needed to combat the virus.

What Happens to Paid Leave Under the FFCRA After December 31, 2020?

Until this week, it was uncertain whether Congress would extend the FFCRA into next year. Congressional leaders, however, have agreed on a $900 billion coronavirus relief bill (the “Bill”) that provides an answer to the fate of the paid leave provisions under the FFRCA. The current version of the legislation (signed by the President December 27, 2020) results in the following:

- Required paid leave under FFCRA ends on December 31, 2020.

- As of January 1, 2021, covered employers may voluntarily provide emergency paid sick leave or emergency paid leave under FFCRA to continue receiving the tax credit benefits associated with this leave. The tax credit may only be taken for leave through March 31, 2021.

Therefore, effective January 1, 2021, paid leave under the FFCRA will no longer be required. Covered employers who voluntarily provide paid leave benefits under the FFCRA through March 31, 2021, will remain eligible to receive tax credits for the paid leave. It should be noted, the Bill does not seem to provide a new set of tax credits or leave. In other words, if an employee has already taken 80 hours of emergency paid sick leave in 2020, then the employee would not be entitled to new emergency paid leave in 2021. With respect to the expanded family and medical leave provisions, presumably, if the employer’s 12-month period for FMLA resets under the employer’s policy, the employee would be entitled to paid FMLA again. It is not clear whether that was the Department’s intent or whether future guidance will provide otherwise.

How Does the Bill Impact California’s Supplemental Paid Sick Leave?

Although larger employers, with 500 or more employees, are not governed by the FFCRA, California enacted supplemental paid sick leave (“SPSL”) to account for time off due to COVID-19-related reasons. In California, covered employers are required to provide SPSL to their eligible employees through: (i) December 31, 2020, or (ii) an extension of the FFCRA. It is currently unclear whether the paid leave provisions under the Bill, given its voluntary nature, would constitute as an “extension.” Therefore, until California provides further guidance, it remains unclear whether covered employers will be required to provide SPSL to their eligible employees through March 31, 2021.

Key Takeaways:

- Under the FFCRA, covered employers are only required to provide emergency paid sick leave or emergency paid Family and Medical Leave Act until December 31, 2020.

- Effective January 1, 2021, covered employers under FFCRA may voluntarily provide emergency paid sick leave or emergency paid Family and Medical Leave Act to take the tax credit associated with this leave through March 31, 2021.

- While covered employers under the FFCRA are no longer required to provide paid leave under federal law as of January 1, 2021, they should remain mindful of other paid leave requirements under state and local laws.

- In California, while employers with more than 500 employees are required to provide SPSL through at least December 31, 2020, it is possible it will be extended. So stay tuned!

For more information or resources regarding the FFCRA, California’s SPSL, or other COVID-related laws applicable to employers and/or employees, please refer to Hoge Fenton’s Employment Law Group’s resource page (here), or feel free to contact a member of the Employment Law Group.

|

Maysa Saeed is an associate attorney whose practice focuses on employment counseling and litigation and assists clients in all aspects of employment law. Prior to joining Hoge Fenton, Maysa was a litigation associate with experience litigating various commercial, employment, and real estate matters. Maysa’s prior legal experience also includes defending insurance carriers in administrative trials before the Workers’ Compensation Appeals Boards in San Jose and Salinas. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Embert P. Madison, Jr. is a transactional associate and his practice focuses on real estate, employment advice and counsel, and cannabis regulation. He has represented clients in commercial real estate transactions throughout California, Texas, and Florida. Embert has extensive cannabis regulatory experience representing both local governments and private businesses. He has drafted cannabis business and zoning regulations for nine cities in Northern and Central California. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

11.25.2020 | Firm Post

by Jenn Protas, Shareholder and Attorney

Sarju Naran, Shareholder and Employment Law Chair

On Friday, November 20, 2020, the California Department of Industrial Relations’ Occupational Safety and Health Standards Board adopted emergency temporary standards to protect employees from hazards related to COVID-19. Although the emergency standards must be approved by the Office of Administrative Law (“OAL”), the OAL must review and approve the emergency standards by November 30, which, if approved (as is expected), will become effective immediately. This requires California employers to act urgently to implement policies and procedures to comply.

The new emergency safety orders apply to all employees and places of employment in California except (1) places of employment with one employee who does not have contact with other persons, (2) employees working from home, and (3) employees when covered by 8 CCR section 5199 (related to facilities, services, and operations dealing with aerosol transmissible diseases).

The new safety orders would require employers to establish, implement, and maintain an effective, written COVID-19 Prevention Program, which may be integrated into the employer’s Injury and Illness Prevention Program or maintained in a separate document. The COVID-19 Prevention Program1 must include:

- A system for communicating information to employees regarding prevention, testing, symptoms, and a system for reporting exposure without fear of reprisal.

- Identification and evaluation of COVID-19 hazards, including, among other things, screening employees for and responding to employees with COVID-19 symptoms and effectively and immediately responding to COVID-19 positive employees to prevent or reduce the risk of transmission in the workplace.

- Investigating and responding to COVID-19 cases in the workplace, including policies and procedures to identify and give notice of COVID-19 exposure, within one business day, while maintaining confidentiality, and offering testing at the employer’s expense during work hours to workers who may have been exposed.

- Correction of COVID-19 hazards, including correcting unsafe conditions and work practices.

- Providing training and instruction to employees regarding, among other things, COVID-19-related benefits, social distancing, methods of how the virus spreads, wearing face coverings, and handwashing.

- Adopting site-specific strategies to maximize health standards, including solid partitions, outdoor ventilation, cleaning and disinfecting procedures, and providing PPE.

- Reporting, recordkeeping, and access – requiring employers to report workplace COVID-19 cases to the health department when required by law, maintain records of steps taken to implement the written COVID-19 Prevention Program, maintain records and tracking of COVID-19 cases.

- Removing workers who are positive or exposed to COVID-19 from the workplace and maintaining excluded employees’ earnings, seniority, rights and benefits. The employer may use employer-provided sick leave benefits for this purpose and consider benefit payments from public sources in determining how to maintain earnings, rights, and benefits where permitted by law and when not covered by workers’ compensation. The requirement to maintain pay, rights, and benefits does not apply for the period of time the employee is otherwise unable to work for reasons other than to protect employees from transmission, or where the employer demonstrates the COVID-19 exposure was not work-related.

- Criteria for employees to return to work after recovering from COVID-19: When symptomatic, the employee shall not return until (1) at least 24 hours have passed since a fever of 100.4 or higher has resolved without fever-reducing medication, (2) COVID-19 symptoms have improved, and (3) at least 10 days have passed since COVID-19 symptoms first appeared. When asymptomatic, an employee may not return until a minimum of 10 days have passed since specimen collection of their first positive COVID-19 test.

- An employer may not require a negative COVID-19 test for employees to return to work.

Additional testing and notification requirements are set forth in a place of employment with a COVID-19 outbreak (when there are three or more COVID-19 cases in an exposed workplace within a 14-day period) and major outbreaks (20 or more cases within a 30-day period). There are also specific requirements set forth where employers provide housing and transportation to and from work.

1There are additional nuances and requirements not identified here. Please consult the regulations for further details.

A Few Key Takeaways

- You should begin drafting your COVID-19 Prevention program now, since it will likely become required as of Monday, November 30, 2020.

- Without identifying who tested positive, within one business day of learning that someone in the workplace tested positive, you must provide notice of the potential exposure to all employees and independent contractors who were either exposed to the person or present at the worksite during the exposure period.

- All employees who were within six feet of someone who tested positive for a cumulative period of 15 minutes or longer within a 24-hour period need to be put on paid leave for 14 days from the last known exposure.

- You can require the use of sick time, PTO, FFCRA, or other benefit payments from public sources to maintain employees’ pay when they are on leave, but if they have used all those pay benefits, you simply have to continue paying them anyway. That is a bold and abrupt requirement, especially coming from Cal/OSHA through an emergency regulation, and it could create substantial expense for employers.

- You must allow employees to return to work after testing positive once the specified time and symptoms have passed (different criteria based on whether the employee is symptomatic or asymptomatic). You cannot require a negative test before allowing the employee to return to work.

- In the event of an outbreak (three or more positive cases within 14 days), all employees who were in the workplace during the period of the outbreak must be tested twice: (1) immediately, and (2) one week later. Thereafter, all employees who remain at the workplace must continue to be tested at least weekly until there are no more positive cases for a 14-day period.

- In the event of a major outbreak (20 or more positive cases within 30 days), all employees who were in the workplace during the 30-day period must be tested twice per week until there are no more positive cases for a 14-day period.

Meet Our Employment Law Team

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Embert P. Madison, Jr. is a transactional associate and his practice focuses on real estate, employment advice and counsel, and cannabis regulation. He has represented clients in commercial real estate transactions throughout California, Texas, and Florida. Embert has extensive cannabis regulatory experience representing both local governments and private businesses. He has drafted cannabis business and zoning regulations for nine cities in Northern and Central California. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

09.23.2020 | Firm Post

Thank you to everyone who joined us for our Employee Lawsuits on the Rise webinar today with Employment Law Chair Sarju Naran and Employment Law Attorney Jenn Protas.

Please click below to watch the recording.

We hope you enjoyed the presentation. Please do not hesitate to reach out to us at webinars@hogefenton.com if you have any inquires for Sarju or Jenn.

Feel free to visit our Vimeo page for a full library of Hoge Fenton webinar recordings and check out our News & Events page for our latest legal updates and webinars.

Meet our Trusted Advisors

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

09.21.2020 | Firm Post

by Jenn Protas, Shareholder and Attorney, Employment Law Group

Governor Gavin Newsom approved an historic expansion of the California Family Right Act (“CFRA”) in signing Senate Bill (“SB”) 1383.

Existing Law

Under existing law, the California Family Rights Act requires employers with 50 or more employees within a 75-mile radius to grant a leave of absence to eligible employees of up to 12 workweeks in a 12-month period for permitted purposes, including to bond with a new child or to care for themselves or a child, parent, or spouse. The baby bonding requirements of the CFRA were expanded effective January 1, 2018 under the New Parent Leave Act to apply to employers with 20 or more employees within a 75-mile radius for eligible employees. Further, under existing law, where both parents worked for the employer, the employer was only required to grant a combined 12 weeks of leave for baby bonding purposes under the CFRA and New Parent Leave Act.

What’s Changed

SB 1383, which becomes effective January 1, 2021, expands the CFRA to apply to private employers with five or more employees (regardless of the number of employees within a 75-mile radius). Once effective, employers with five or more employees must grant eligible employees (those who have more than 12 months of service with the employer and who have at least 1,250 hours of service with the employer during the previously 12 months) up to a total of 12 workweeks in any 12-month period (as defined by the employer) for job-protected family care and medical leave. CFRA leave may be taken for the following purposes:

- To bond with a child following the birth of the employee’s child or the placement of a child with an employee in connection with the adoption or foster care of the child by the employee (“baby bonding”)

- The new bill removed the ability for employers of both parents to limit baby bonding leave to a total of 12 workweeks for such purposes; now, each parent is entitled to receive 12 workweeks of CFRA baby bonding leave even if they both work for the same covered employer.

- To care for a child, parent, grandparent, grandchild, sibling, spouse, or domestic partner with a serious health condition

- The definition of child no longer applies only to children under age 18 or adult dependent children; child is now expanded to cover all adult children, regardless of dependency status

- Note that the FMLA and the CFRA, previously, only allowed time to care for a parent, spouse (including domestic partner under the CFRA), or child with a serious health condition

- Because of an employee’s own serious heath condition that makes the employee unable to perform the functions of the position, except for disability on account of pregnancy, childbirth, or related medical conditions (California provides for such leave under Pregnancy Disability Leave)

- Because of a qualifying exigency related to the covered active duty or call to covered active duty of an employee’s spouse, domestic partner, child, or parent in the Armed Forces of the United States (bringing the CFRA more in line with the FMLA, which already provides for qualifying exigency leave)

CFRA is generally unpaid, however, employees may elect, and in some cases, employers may require, employees to use accrued vacation leave or paid time off, and, where the leave is to care for themselves, sick leave.

Employers are required to maintain and pay for coverage under any group health plans for the duration of the CFRA-qualifying leave at the level and under the conditions coverage would have been provided if the employee had continued employment continuously during the leave.

CFRA leave is job-protected, meaning that the employer must provide the employee, upon granting the leave request, a guarantee of employment in the same or a comparable position upon termination of the leave. The new bill removed the “key employee” exception from the prior law; an employer may no longer refuse to reinstate salaried employees who are among the highest paid 10% of the employees where refusal is necessary to prevent substantial and grievous economic injury.

What’s Next

The CFRA’s provisions have changed—even for larger employers—so all employers with five or more employees should add or update their CFRA policies in their employee handbooks. Employers who were not previously subject to the CFRA should spend some time understanding how this new law will interact with their currently practices; the learning curve may be steep. The Employment Law Team at Hoge Fenton is ready to help.

Have a dispute with an employee, or questions regarding employment or COVID-19?

Contact our Employment Law Group at info@hogefenton.com.

Meet Our Employment Law Group

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Embert Madison, Jr. focuses on employment advice and counsel, cannabis regulation, and real estate matters. He has represented clients throughout California. Embert spent several years as an attorney in the California Capitol. During this time, he “toed the political ropes” in the areas of employment, taxation and real estate for a California Assembly Member and served in the Office of Legislative Counsel. |

|

Ashlee Cherry is an experienced litigator and represents clients with employment law needs ranging from wage and hour disputes and wrongful termination to disability and leave matters. Ashlee is a board member of the Santa Clara County Employer Advisory Council (EAC). |

|

Laura Riparbelli aggressively litigates employment law disputes. Laura has handled all aspects of litigation from start to finish, including second chairing three bench trials. She regularly prepares and argues challenges to initial pleadings, discovery disputes, and dispositive motions. Laura adeptly navigates all facets of the written and oral discovery process. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

09.21.2020 | Firm Post

by Sarju Naran, Shareholder and Chair, Employment Law Group

On September 17, 2020, Gov. Gavin Newsom signed two employment law bills pertaining to COVID-19: Senate Bill (SB) 1159 and Assembly Bill (AB) 685.

SB 1159

As many employers recall, Governor Newsom signed a 60-day Executive Order in May 2020 that created a rebuttable presumption that employees who tested positive for COVID-19 within 14 days of being at a worksite had a workers’ compensation claim. The order expired on July 5, 2020, leading employers to believe that the burden had shifted back to employees to establish that they were infected with COVID-19 in the course of their employment. SB 1159 now affords employees the same rebuttable presumption retroactive to July 6, 2020 and extending through January 1, 2023, but only if the company has 5 or more employees, and only if the employee tests positive for COVID-19 during an “outbreak” at the employee’s worksite. SB 1159 defines “outbreak” based on employee headcount: (1) for employers with 100 or fewer employees at the worksite, an outbreak means 4 or more employees test positive within a 14-day period; (2) for employers with more than 100 employees at the worksite, an outbreak means at least 4% of the employees test positive within a 14-day period.

SB 1159 also extends the rebuttable presumption to first responders and employees in the health care field.

Employers can submit evidence to attempt to rebut the presumption, including but not limited to, “evidence of measures in place to reduce potential transmission of COVID-19 in the employee’s place of employment and evidence of an employee’s nonoccupational risks of COVID-19 infection.”

SB 1159 also requires employers with 5 or more employees to notify their workers’ compensation carrier within 30 days from the passage of the law about employees who have tested positive since July 6, 2020; going forward, employers are required to report positive tests within 3 days of being notified of an employee’s positive test.

Because SB 1159 was passed as an emergency measure, it is effective immediately.

AB 685

AB 685 requires employers to notify all employees within 1 business day if the employer receives notice that an employee at the worksite was potentially exposed to COVID-19. Employers are also required to provide the employees with “information regarding COVID-19-related benefits to which the employee may be entitled under applicable federal, state, or local laws, including, but not limited to, workers’ compensation, and options for exposed employees, including COVID-19-related leave, company sick leave, state-mandated leave, supplemental sick leave, or negotiated leave provisions, as well as anti-retaliation and anti-discrimination protections of the employee.” Employers must also provide notice of the disinfection and safety plan that the employer plans to implement and complete per the guidelines of the federal Centers for Disease Control.

Additional notice is required if the employees belong to a union and have an exclusive representative.

Further, employers must also notify local public health officials within 48 hours if the number of positive cases meets the State Department of Public Health’s definition of an “outbreak.”

Have a dispute with an employee, or questions regarding employees and COVID-19?

Contact our Employment Law Group at info@hogefenton.com.

Meet Our Employment Law Group

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Jenn Protas helps employers navigate California’s numerous employment laws and defends employers with an eye toward successful, yet cost-effective resolution. Jenn is a committed advocate for her clients and a tenacious litigator. She defends employers on matters related to wage and hour law, wrongful termination, harassment, discrimination, and retaliation in single-plaintiff litigation, Private Attorney General Act actions, and/or class actions. Jenn’s practice also includes housing discrimination matters and business litigation. |

|

Embert Madison, Jr. focuses on employment advice and counsel, cannabis regulation, and real estate matters. He has represented clients throughout California. Embert spent several years as an attorney in the California Capitol. During this time, he “toed the political ropes” in the areas of employment, taxation and real estate for a California Assembly Member and served in the Office of Legislative Counsel. |

|

Ashlee Cherry is an experienced litigator and represents clients with employment law needs ranging from wage and hour disputes and wrongful termination to disability and leave matters. Ashlee is a board member of the Santa Clara County Employer Advisory Council (EAC). |

|

Laura Riparbelli aggressively litigates employment law disputes. Laura has handled all aspects of litigation from start to finish, including second chairing three bench trials. She regularly prepares and argues challenges to initial pleadings, discovery disputes, and dispositive motions. Laura adeptly navigates all facets of the written and oral discovery process. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

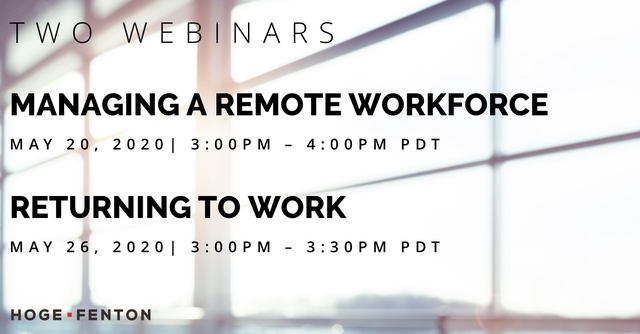

08.25.2020 | Speaking Engagements & Firm Events

Managing a remote workforce presents unique challenges. With the unexpected shift to working from home when the shelter-in-place orders went into effect, most employers did not have time to consider the risks and put safeguards in place. However, as remote working becomes an ongoing and potentially long-term option, employers should take the time to consider several issues our advisors will discuss in the webinar below:

- The legal risks of managing a remote workforce

- Best practices employers should have in place to manage those risks and otherwise comply with laws

- How employers can secure their confidential information with a remote workforce

Meet our Trusted Advisors

|

Sarju Naran is a zealous advocate for his clients and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Stephanie O. Sparks is a shareholder and chairs the firm’s Privacy & Data Security team. She counsels companies on privacy laws and helps them develop and implement administrative, technical, and physical safeguards for data security. Stephanie also provides privacy and data security awareness training; prepares privacy, bring your own device and other privacy-related company policies, record retention/destruction schedules, and data breach incident response plans; and drafts and negotiates data processing agreements, and other agreements involving privacy, data transfers and data protection. |

|

As Development Director of ZAG Technical Services, Joe Foos leads the firm’s new partnerships and alliances with client industry associations, vendor peer groups, and community organizations. He enables clients to succeed by advising them on how to leverage technology for a competitive advantage. For over 25 years, Joe has worked with organizations in the Silicon Valley Bay Area and beyond, always starting with asking why a choice is being made, before helping with the mechanics of how to support or change a decision, for a better outcome. |

|

Hon. Catharine Baker will be moderating the discussion. She is currently Special Counsel at Hoge Fenton in Pleasanton, California. Catharine was a Member of the California State Assembly for the 16th District from 2014 – 2018. During her legislative tenure, Catharine developed a reputation as an independent, bipartisan voice in the CA Legislature, fostering collaboration that led to breakthroughs in significant legislation, particularly on transportation, the environment, and government accountability. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

07.20.2020 | Firm Post

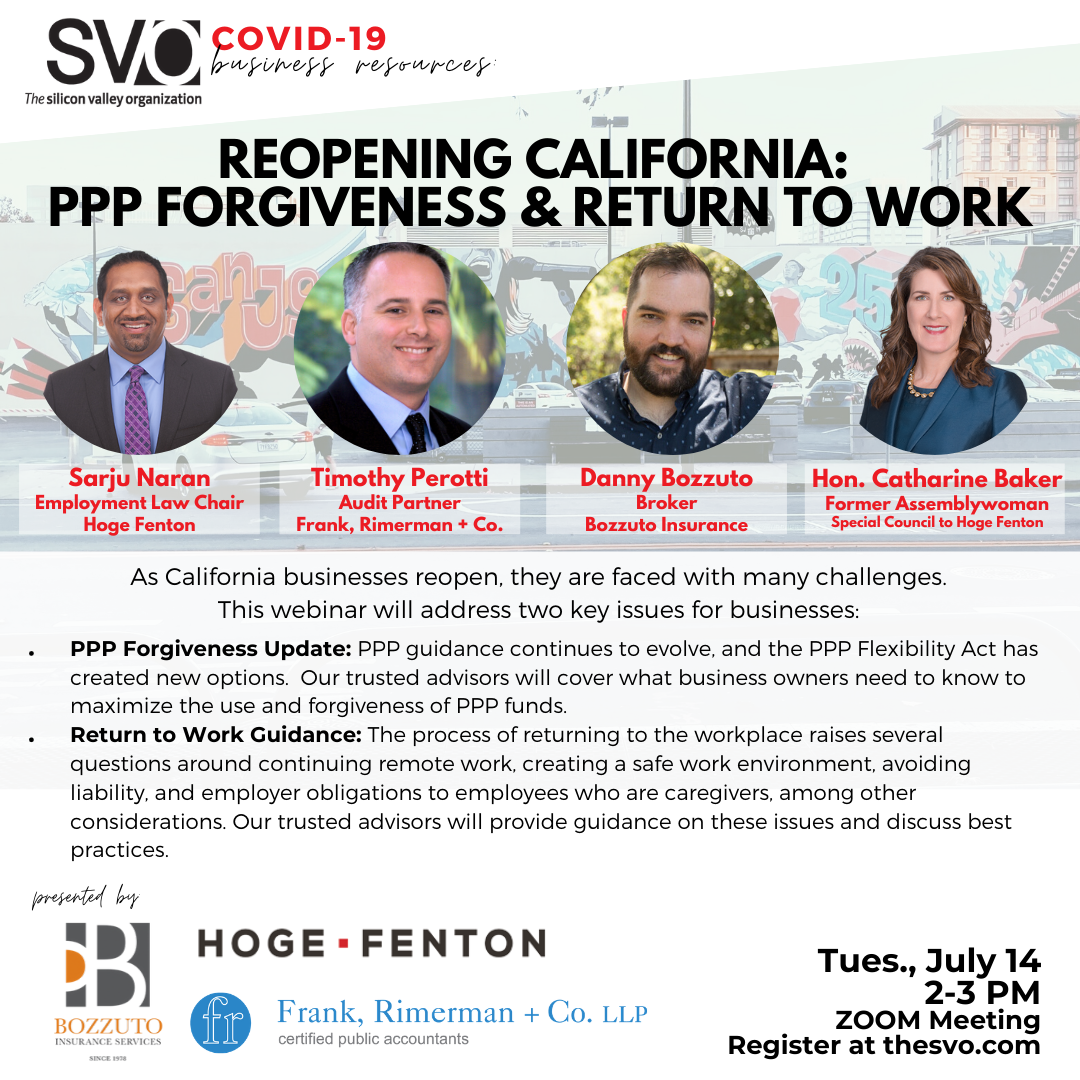

Thank you to everyone who joined us for our Reopening California webinar with The Silicon Valley Organization and Bozzuto Insurance Services. Please click below to watch the recorded webinar.

We hope you found the discussion with our panelists helpful. Please reach out to our advisors below if you need additional guidance.

Shareholder, Chair

Employment Law

Hoge Fenton

+1.408.947.2456

|

Former Assemblywoman

Special Counsel

Hoge Fenton

+1.925.224-7780

|

Partner

Assurance & Advisory

Frank Rimerman + Co. LLP

+1.415.439.1147

|

Commercial Insurance Broker

Bozutto Insurance Services

+1.408.680.0253

|

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

07.07.2020 | Speaking Engagements & Firm Events

Meet Our Trusted Advisors

|

Sarju Naran is a zealous advocate for his clients, and approaches litigation with creativity and strategy. Chair of Hoge Fenton’s Employment Law Group, Sarju’s experience spans from representing middle-market and family-owned closely held businesses to large multi-national companies. He regularly litigates and provides advice and counsel to companies on wage and hour issues, trade secret misappropriation, employee mobility, wrongful termination, performance management, and leaves of absence. |

|

Timothy Perotti is the partner in charge of the Assurance and Advisory Practice at Frank, Rimerman + Co. LLP. Working primarily out of the San Francisco and Palo Alto offices. TIm’s expertise includes revenue recognition, equity accounting, and mergers and acquisition transactions. He has over 20 years of experience providing technical accounting, financial reporting, and advisory services to businesses in the professional service, manufacturing, distribution, software, and high-technology industries. |

|

Hon. Catharine Baker is currently Special Counsel at Hoge Fenton in Pleasanton, California. Catharine was a Member of the California State Assembly for the 16th District from 2014 – 2018. During her legislative tenure, Catharine developed a reputation as an independent, bipartisan voice in the CA Legislature, fostering collaboration that led to breakthroughs in significant legislation, particularly on transportation, the environment, and government accountability. |

|

Danny Bozzuto has been a broker at Bozzuto & Associates Insurance Services since 2010. Danny developed Bozzuto’s Human Resources Services and Technology programs in the Bay Area and Southern California. He has served on advisory committees, participated as a panelist for risk management, and developed exclusive programs for Bozzuto. Danny has also taken on an additional role of maintaining Bozzuto’s carrier relations. |