Additional Resources |

12.28.2020 | Firm Post

by Darlene Chiang and Tim Maximoff, Corporate & Business Law Group

On Monday, December 21, 2020, Congress passed a $900 billion pandemic relief package that would inject another round of long-awaited cash to businesses and individuals who are in financial distress due to the COVID-19 pandemic. President Trump signed the bill on Sunday night, December 27, 2020.

Notably, the new relief plan will bring significant changes and clarifications to Paycheck Protection Program loans. Here are some highlights:

- Tax deduction: The most exciting change is that the new relief bill finally responds to the outcry of borrowers by making clear that income tax deductions are allowable for expenses paid with proceeds of a forgiven PPP loan (PPP forgiveness is still not taxable income, and tax basis and other attributes of the borrower’s assets will not be reduced).

- New Pool: Adds an additional $284 billion for PPP loans, expands relief to nonprofit organizations and will offer additional support to struggling small businesses.

- Second draw: Allows some businesses to receive an additional PPP loan (“Second Draw”), which is targeted to smaller and harder-hit businesses. Businesses must have less than 300 employees per location and demonstrate at least a 25% reduction in gross receipts in the first, second, or third quarter of 2020 relative to the same 2019 quarter. Businesses that were not in business for all quarters must demonstrate appropriate reductions during the months they were in business (for example, they can compare earlier 2020 quarters rather than compare to 2019). Applications submitted on or after January 1, 2021, are eligible to utilize the gross receipts from the fourth quarter of 2020 in this analysis.

- Borrowing Amount: Allows entities in industries assigned to NAICS code 72 (accommodation and food services) to receive loans of up to 5 times their average monthly payroll cost (increased from 2.5).

- Forgiveness: The definition of qualified expenses was expanded to include software, cloud computing, human resources, payroll, billing and accounting, costs related to “property damage and vandalism or looting due to public disturbances” that occurred during 2020 and are not covered by insurance, supplier costs, and worker protection related to social distancing, sanitation or other safety requirements.

- Simplified Forgiveness Application: The bill mandates a simplified forgiveness application (”not more than one page in length”) for loans up to $150,000. The application will require a description of the number of employees the borrower was able to retain because of the covered loan, the estimated total amount of the loan spent on payroll costs, and the total loan amount.

- Dedicated Funding to Live Venues and other Businesses: The bill provides $15 billion for live venues, independent movie theaters, and cultural institutions. Funds are also earmarked for non-profits and news outlets that weren’t eligible in the first round.

In addition to the changes made to the PPP program, the new stimulus bill also provides additional relief, including:

- Individuals making up to $75,000 a year will receive a payment of $600, while couples making up to $150,000 will receive $1,200, in addition to $600 per child.

- 11 weeks of unemployment insurance benefits of $300 per week for jobless Americans through March 14, 2021.

- Extension to a moratorium on evictions to January 31, 2021 that was slated to expire at the end of the year. The incoming Biden administration can extend the deadline further.

- $25 billion in emergency assistance to renters.

Meet Our Attorneys

|

Darlene Chiang provides domestic and international clients with practical legal solutions to resolve issues as they progress through their critical lifecycle milestones from formation, debt and equity financing, entering strategic technology transfer and commercial transactions, to successful exit by merger and acquisitions. Darlene has extensive experience representing high growth companies and their investors as well as mature privately held companies and their founders. Darlene is fluent in Chinese and routinely works with international companies to set up and expand their US presence. |

|

Tim Maximoff counsels his clients in estate planning and estate and trust administration, tax, business, and related matters. Tim works with his clients and their accountants and financial advisors in tax and business planning and, when necessary, represents individual, estate, and business clients in federal, state, and property tax audits, appeals, and litigation. Tim uses his 30 years of experience to explain to clients the practical issues, complex law, and tax rules that impact their situation and help them reach their planning goals. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

10.08.2020 | Firm Post

Daniel J. Marsh, Attorney, Business Litigation Group

Beginning on March 12, 2020, California has issued a series of statewide Stay at Home Orders to combat the COVID-19 pandemic. These Stay at Home Orders required many businesses to cease in-person services, resulting in substantial losses. The retail and restaurant industries have been particularly hard hit.

Many business owners may be wondering whether their insurance provides coverage for their losses under the Business Income and Civil Authority provisions in their policy. A series of recent case decisions in California suggests a lack of coverage for such losses, at least for now.

What then, should business owners be doing when faced with a loss? As the old adage goes, “you can’t win if you don’t play.”

- A business should still consider submitting a claim to their insurers.

- Second, a business should collect all necessary information supporting the loss. This includes financial statements, inventory reports, payroll records, invoices, and receipts.

- Finally, reach out to an experienced insurance coverage attorney to review the policy. Not all policies are created the same, and it is possible there is language in the policy that could provide coverage for the loss.

Background

To be entitled to coverage under the Business Income and Civil Authority provisions of their policies, insureds must demonstrate a loss due to “direct physical loss of or damage to” property. In the recent California decisions Mudpie, Inc. v. Travelers Casualty Insurance Co. of America, — F. Supp. – (N. D. Cal. 2020) and Pappy’s Barber Shops, Inc., et al. v. Farmers Group, Inc., et al. 2020 WL 5500221 (S.D. Cal. Sept. 11, 2020) the courts, dismissing claims against the insurance companies, sided with the vast majority of out-of-state decisions that the inability to operate and occupy a business following government closure orders does not constitute a “direct physical loss.” For coverage to exist, there must be some outside physical force that induces a detrimental change to the property’s capabilities (e.g. a wildfire).

COVID-19 as a Physical Force

To date, there appears to be only one case in the United States, out of the Western District of Missouri, in which coverage for a COVID-19-related claim was secured. In Studio 417, Inc. v. Cincinnati Insurance Co., No. 20-CV-03127-SRB, – F.Supp.3d – , 2020 WL 4692385 (W.D. Mo. Aug. 12, 2020), a hair salon and several restaurants sought coverage for losses incurred when their businesses were impacted by the COVID-19 pandemic. The difference in that case, however, is that while these businesses alleged that their properties were actually infected with COVID-19. Thus, the court found that the presence of COVID-19 constituted a physical force that caused the businesses to close.

AB 1552

Although courts in California have determined that coverage does not exist for losses resulting from government closure orders due to COVID-19, at least one court decision, Mudpie, Inc. v. Travelers Casualty Insurance Co. of America, has recognized that the law concerning business interruption coverage linked to the COVID-19 pandemic is “very much in the development.” Indeed, multiple state governments have proposed legislation which would retroactively provide coverage. In California, amended Assembly Bill 1552 was referred to the California Senate Insurance Committee in July 2020. AB 1552 would have made it easier for insured’s to demonstrate proof in a case seeking coverage for business interruption. Specifically, AB 1552 would have created a presumption that:

- COVID-19 was present on specified property and caused physical damage; and

- With respect to an order of civil authority, that COVID-19 was present on property located within the geographical location covered by the order and caused physical damage to that property.

Unfortunately for business owners, AB 1552 has since died in committee, and it is unclear when and/or if future legislation may be put forward or enacted that would provide relief to businesses.

What then, should business owners be doing when faced with a loss? While the reality is that there is unlikely to be coverage for these claim unless (and until) legislation like AB 1552 is passed, a business should still consider submitting a claim to its insurer. Second, collect all necessary information supporting your loss. This includes financial statements, inventory reports, payroll records, invoices, and receipt. Finally, reach out to an experienced insurance coverage attorney to review your policy. Remember, not all policies are created the same, and it is possible there is language in your policy that could provide coverage for your loss.

If you have questions regarding insurance coverage for losses resulting from COVID-19, please reach out to Daniel J. Marsh.

Meet Our Trusted Advisor

|

Daniel J. Marsh is an experienced litigator. He assists clients with all types of business and real estate litigation matters, including complex corporate and partnership disputes, contract disputes, property damage claims, and professional liability matters. In addition, he has specific expertise in business insurance coverage and insurance bad faith litigation. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

08.03.2020 | Firm Post

Thank you to everyone who joined us for our ADA Lawsuits for Websites webinar with Citizens Against Lawsuit Abuse and The Silicon Valley Organization.

Please click below to watch the recorded webinar.

We hope you enjoyed the discussion with Managing Shareholder Dan Ballesteros, Regional Director Julie Griffiths, Former Assemblywoman Hon. Catharine Baker, and CEO Matthew Mahood. Please do not hesitate to reach out to our advisors below if you need more guidance and visit our Reopening California Resources page for additional support.

Our Trusted Advisors

|

|

|

|

Managing Shareholder

+1.408.947.2416

|

Regional Director, N. California

+1.559.213.2240

|

Special Counsel

+1.925.224.7780

|

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

07.23.2020 | Firm Post

Thank you to everyone who joined us for our Cannabis is Essential webinar with San Jose Spotlight and Silicon Valley Cannabis Alliance. Please click below to watch the recorded webinar.

Thank you to everyone who joined us for our Cannabis is Essential webinar with San Jose Spotlight and Silicon Valley Cannabis Alliance. Please click below to watch the recorded webinar.

We hope you enjoyed the discussion with Sr. Advisor on Cannabis Nicole Elliott, Assemblymember Ash Kalra, Councilmember Pam Foley, Cannabis Compliance Director David McPherson, Director of Government Affairs Hirsh Jain, Cannabis Attorney Embert Madison, Jr., and Freelance Reporter Adam Hutton.

Please do not hesitate to reach out to Embert Madison, Jr. if you need more guidance on cannabis regulation and visit our Reopening California Resources page for additional support.

|

|

Attorney

Hoge Fenton

+1.925.460.3370

|

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

07.15.2020 | Speaking Engagements & Firm Events

Meet our Trusted Advisors

|

Dan Ballesteros is an aggressive litigator, with the knowledge and experience to create leverage for your case. Dan’s practice focuses on real estate disputes, arising out of the purchase, sale, leasing, secured lending, ownership and/or use of real property. He represents businesses, LLCs, partnerships and individuals in all phases of litigation, arbitration and mediation. Dan has successfully represented brokers, sellers and buyers in cases involving the nondisclosure of defective conditions; mortgage brokers and lenders against fraudulent borrowers; and property and business owners against serial ADA litigants. |

|

Hon. Catharine Baker is currently Special Counsel at Hoge Fenton in Pleasanton, California. Catharine was a Member of the California State Assembly for the 16th District from 2014 – 2018. During her legislative tenure, Catharine developed a reputation as an independent, bipartisan voice in the CA Legislature, fostering collaboration that led to breakthroughs in significant legislation, particularly on transportation, the environment, and government accountability. |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

06.19.2020 | Firm Post

On June 16, 2020, the U.S. Small Business Administration (“SBA”) released:

- an updated Loan Forgiveness Application, and

- an Alternative Loan Forgiveness Application for certain borrowers to implement the PPP Flexibility Act (“PPP Flex”), and

- a revised interim final rule (the “IFR”) on June 17, 2020 implementing changes from the PPP Flex.

The updated Loan Forgiveness Application covers the following changes:

- Alternative Payroll Covered Period applies to the 24-week (168-day) covered period; provided the Alternative Payroll Covered Period does not extend beyond December 31, 2020. Note: if a Borrower received its PPP loan before June 5, 2020, the Borrower may elect to use an eight-week (56-day) covered period.

- Clarifies one of the Full Time Employee (FTEs) reduction exceptions: A position will not be included in the calculation if the Borrower made a good-faith, written offer to rehire an employee who was employee on February 15, 2020 AND the Borrower was unable to hire similarly qualified employees for unfilled positions on or before December 31, 2020.

- Changes the documentation required for FTEs from the average number of FTEs per month to the average number of FTEs per week.

- Employer health insurance and retirement contributions for business owners: employer health insurance and employer retirement contributions on behalf of a self-employed individual, general partners, or owner-employees of an S-corporation should not be included in the health insurance expenditures calculation or retirement expenditures calculation, respectively.

A copy of the updated application is here and the instructions are here.

A shortened version of the forgiveness application is available for the following borrowers:

- Self-employed, independent contractors, or sole proprietors with no employees;

- Borrowers who did not reduce salaries by more than 25% during the covered period and did not reduce the number of employees or the average paid hours of employees from January 1, 2020 to the end of the Covered Period (ignoring reductions from the safe harbor related to an inability to hire qualified employees, and reductions due to an employee refusing to accept a restoration of hours); and

- Borrowers who did not reduce salaries by more than 25% during the covered period and were unable to operate during the covered period at the same level of business activity due to COVID-19 related safety requirements promulgated by the CDC, HHS, or OSHA.

The Alternative Loan Forgiveness Application is here and the instructions are here.

The SBA also released a revised interim final rule (the “IFR”) on June 17, 2020 implementing changes from the PPP Flex. The IFR provides the following:

Increases the cap on individual employees’ salaries from $15,385 during the 8-week covered period to $46,154 during the 24-week covered period.

Increases the cap on owner compensation from $15,835 during the 8-week covered period, to $20,833 for a 24-week covered period.

For sole proprietors: business mortgage payments, business rent payments, and business utility payments, as listed on Form 1040 Schedule C, are now included as amounts eligible for forgiveness.

Loan forgiveness amount cap: the amount of loan forgiveness is capped by the full principal amount of the loan plus accrued interest.

A copy of the IFR can be found here.

Our experienced team of attorneys are available to further assist you with any more questions or concerns you may having regarding PPP Forgiveness and PPP Flex.

|

|

|

|

Of Counsel

Corporate & Bus Law

+1.925.460.3367

|

Shareholder/Chair

Estates & Trusts

+1.408.947.2437

|

Attorney

Corporate & Bus Law

+1.925.460.3370

|

|

|

|

Shareholder, Chair

Employment Law

+1.408.947.2456

|

Shareholder

Real Estate & Commercial

+1.925.460.3365

|

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

06.08.2020 | Firm Post

A breath of fresh air for PPP borrowers! The Senate unanimously passed the “Paycheck Protection Program Flexibility Act of 2020” (H.R. 7010) (the “PPP Flex”) on Wednesday (6/3) evening and the President signed it into law today. The PPP Flex addresses many concerns with the PPP loan program and relaxes some of the requirements in the original PPP program. We expect the Treasury and the SBA to issue more guidance on the PPP Flex in the near future. Although the PPP Flex offers some relief and clarity, there are new considerations. Borrowers who already plan on using the PPP funds within the original 8 week covered period can choose to do so and may decide to request loan forgiveness as soon as possible. Below is a list of major changes covered in the PPP Flex bill:

| Update | PPP / Initial SBA Guidance | PPP Flex |

|

1) Extended Loan Forgiveness Covered Period

|

8 weeks (56 days) from receipt of loan proceeds, or from first date of payroll period after receipt of loan proceeds for those eligible to apply “Alternative Payroll Covered Period”. |

Earlier of 24 weeks or December 31, 2020. Borrowers who received a PPP loan before the date of the enactment of PPP Flex may retain the 8 week covered period.

|

| 2) Lower Payroll Cost Percentage Requirement | At least 75% of loan proceeds must be spent on eligible payroll costs, otherwise the loan forgiveness amount will be proportionally reduced. |

At least 60% of loan proceeds must be spent on eligible payroll costs. This now appears to be a cliff. (i.e., a Borrower who spends only 59% on eligible payroll costs will receive no forgiveness)*

[* Note: Subject to SBA regulation to determine if it is a cliff, but the current statutory language suggests it is a cliff ]

|

| 3) Extended Reduction in Work Force Safe Harbor Rehire Date | June 30th deadline to rehire employees separated between February 15, 2020 and April 26, 2020, to avoid a reduction in loan forgiveness. | December 31, 2020 deadline to rehire employees separated between February 15, 2020 and April 26, 2020, to avoid a reduction in loan forgiveness. |

| 4) New Exceptions for Borrowers who do not hire/rehire workers before the Rehire Date | No reduction in loan forgiveness if the Borrower offers reemployment and workers reject the offer to return to work. |

New exceptions (in addition to the prior exception) if the Borrower:

|

| 5) Longer Repayment Period | 2 years | 5 years (for loans after the enactment of PPP Flex; existing PPP borrowers might ask lenders to extend the loan. |

| 6) Deferral of Employer Share of Payroll Taxes | Not available for a Borrower who had the PPP loan forgiven. | Available for all PPP borrowers regardless of forgiveness status; allows Borrowers to defer payment of 50% of payroll taxes until 2021, with the remaining 50% due in 2022. |

Our experienced team of attorneys are available to further assist you with any more questions or concerns you may having regarding the Paycheck Protection Program Flexibility Act of 2020.

|

|

|

|

Of Counsel

Corporate & Bus Law

+1.925.460.3367

|

Shareholder/Chair

Estates & Trusts

+1.408.947.2437

|

Attorney

Corporate & Bus Law

+1.925.460.3370

|

|

|

|

Shareholder, Chair

Employment Law

+1.408.947.2456

|

Shareholder

Real Estate & Commercial

+1.925.460.3365

|

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

06.04.2020 | Firm Post

We are Here to Help

Hoge Fenton understands that our clients, employers, and organizations may have numerous questions and concerns about reopening their business. As you begin to face the business and legal implications of the COVID-19 crisis, our attorneys remain committed to assisting you overcome these obstacles.

To provide some guidance on some of the issues that have affected or will be affecting businesses, we have created a Reopening California resources page to support you in the following areas:

- Bankruptcy Information

- Corporate & Business Law

- Employment Law

- Family Law Counseling & Litigation

- Intellectual Property

- Real Estate and Land Use

- Tax/Trusts & Estates

This information is provided as an educational service by Hoge Fenton for clients & friends of the firm. This communique is an overview only, & should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

05.19.2020 | Firm Post

On the evening of Friday, May 15, the SBA released long-awaited guidance for borrowers looking to claim forgiveness of their Paycheck Protection Program (“PPP”) loans.

The PPP Loan Forgiveness Application provides detailed instructions for borrowers to calculate the amount of their PPP loan forgiveness. The application has four parts:

- the PPP Loan Forgiveness Calculation Form;

- PPP Schedule A;

- the PPP Schedule A Worksheet; and

- an optional PPP Borrower Demographic Information Form.

Borrowers are required to submit the Calculation Form and PPP Schedule A to their lender.

What Costs are Eligible for Forgiveness?

The SBA’s guidance provides for four broad categories of costs that are eligible for forgiveness:

- payroll costs;

- business mortgage interest payments;

- business rent or lease payments; and

- business utility payments.

In accordance with prior guidance, the SBA requires that at least 75% of the forgiven amount be attributable to payroll costs.

Calculation of Eligible Payroll Costs for Forgiveness

The SBA’s guidance allows a PPP borrower to deduct payroll costs paid or incurred during the borrower’s eight-week (56 day) “Covered Period,” which is defined as the eight-week period that begins on the date the PPP loan was disbursed, or an Alternative Payroll Covered Period.

Alternative Covered Period

The strict eight-week Covered Period may not align with a borrower’s actual pay period. In these cases, the Alternative Covered Period may be used. The Alternative Payroll Covered Period allows Borrowers with a biweekly (or more frequent) payroll schedule to choose a 56 day period that begins on the first day of their first pay period following their PPP Loan Disbursement Date.

- Example: Borrower received its PPP loan proceeds on Monday, April 20. The first day of its first pay period following its PPP loan disbursement is Sunday, April 26. Therefore, the first day of the Alternative Payroll Covered Period is April 26 and the last day of the Alternative Payroll Covered Period is June 20 (a Saturday).

Borrowers who elect to use the Alternative Payroll Covered Period must apply the Alternative Payroll Covered Period wherever there is a reference in this application to “the Covered Period or the Alternative Payroll Covered Period.”

Note: The Alternative Payroll Covered Period applies to Payroll expenses only! Borrowers must apply the Covered Period (not the Alternative Payroll Covered Period) for other costs!

Date when Payroll Costs are Considered to be Paid

Payroll costs are considered paid on the day that paychecks are distributed or the day that the borrower originates an ACH credit transaction. Payroll costs are considered incurred on the day that the employee earned the pay. This distinction allows employers some flexibility in timing their use of PPP funds.

If a payroll cost is incurred but not paid during the borrower’s last pay period of the Covered Period or the Alternative Payroll Covered Period, that payroll cost is still eligible for forgiveness if the borrower pays it by its next regular payroll date. Otherwise, all payroll costs must be paid during the Covered Period or the Alternative Payroll Covered Period.

Calculation of Eligible Non-Payroll Costs for Forgiveness

Non-payroll costs eligible for forgiveness consist of the following three categories:

- Covered mortgage obligations: Payments of interest (any prepayment or payment of principal is excluded) on any business mortgage obligation on real or personal property incurred before February 15, 2020.

- Covered rent obligations: Business rent or lease payments pursuant to lease agreements for real or personal property in force before February 15, 2020.

- Covered utility payments: Business utility payments during the Covered Period for business utilities for which service began before February 15, 2020. Allowable business utility payments include payments for electricity, gas, water, transportation, telephone, or internet access.

An eligible non-payroll cost must be either:

- paid during the Covered Period, or

- incurred during the Covered Period and paid on or before the next regular billing date, even if the billing date is after the Covered Period.

Eligible non-payroll costs cannot exceed 25% of the total forgiveness amount. Borrowers are to count non-payroll costs that were both paid and incurred only once.

Determining Full-Time Equivalency of Employees

The CARES Act, which created the PPP, provided that a borrower’s forgiveness amount is limited if there is a reduction in the average number of full-time equivalent employees during the Covered Period as compared to a past reference period.

The SBA’s guidance provides rules for calculating the average full-time equivalency (“FTE”).

- Borrowers calculate the average number of hours paid per week for each employee during the Covered Period or the Alternative Payroll Covered Period.

- This number is divided by 40, and rounded the total to the nearest tenth an hour. The maximum for each employee, however, is capped at 1.0. Alternatively, borrowers can use a simplified method that assigns a 1.0 for employees who work 40 hours or more per week and 0.5 for employees who work fewer hours may be used at the borrower’s election.

Borrowers should be relieved to learn that the SBA’s guidance provides several exemptions to the FTE reduction rules that would otherwise limit the borrower’s forgiveness. For example, a borrower will not be penalized for FTE reductions that result from either of the following circumstances:

- Reductions related to any positions for which the borrower made a good-faith, written offer to rehire an employee during the Covered Period or the Alternative Payroll Covered Period that was rejected by the employee.

- Reductions related to any employees who during the Covered Period or the Alternative Payroll Covered Period (a) were fired for cause, (b) voluntarily resigned, or (c) voluntarily requested and received a reduction of their hours

Overall, the PPP Loan Forgiveness Application and associated guidance provides some much needed clarity for borrowers. Please note there is more information provided in the guidance than is covered by this communication. Please reach out to any of our Hoge Fenton attorneys below for further information.

|

|

|

|

|

Of Counsel

Corporate & Bus Law

+1.925.460.3367

|

Attorney

Corporate & Bus Law

+1.925.460.3370

|

Jenn Protas Shareholder Employment Law +1.408.947.2435 email here |

Sarju Naran Shareholder/Chair Employment Law +1.408.947.2456 email here |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

05.15.2020 | Firm Post

The SBA’s new rule enables lenders to increase existing PPP loans to partnerships and seasonal employers. In addition, it provides additional clarification on the return of funds and self-certification aspects of the PPP funds.

Partnerships who completed their loan applications before April 14: PPP lenders are now allowed to increase existing PPP loans to partnerships to include appropriate amounts to cover partner compensation in accordance with the April 14 interim final rule.

The April 14 interim rule prohibited partners in partnerships from submitting a separate PPP loan application for themselves as self-employed individuals. Instead, the self-employment income of general active partners was to be reported as a payroll cost (up to $100,000 annualized). Partnerships, including accounting firms, that had submitted PPP applications prior to April 14th without including partner self-employment income likely did not receive the maximum amount of PPP loans for which they were eligible.

Seasonal Employers: PPP lenders are now allowed to increase existing PPP loans to seasonal employers to include appropriate amounts based on the seasonal employer’s maximum loan value using the alternative criterion posted on April 24.

Extension of date to return PPP funds: Borrowers who received PPP loans now have until May 18th to return the PPP funds if they are unable to make good-faith certification of the necessity of their loan requests.

Businesses who accepted less than $2 million in PPP funds: The SBA will take these businesses’ self-certifications of necessity on good faith and will not require them to prove the necessity of their loan.

If you have any questions or need assistance with your PPP loan, please do not hesitate to contact Darlene Chiang.

|

|

Of Counsel

Corporate & Bus Law

+1.925.460.3367

|

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

05.06.2020 | Speaking Engagements & Firm Events

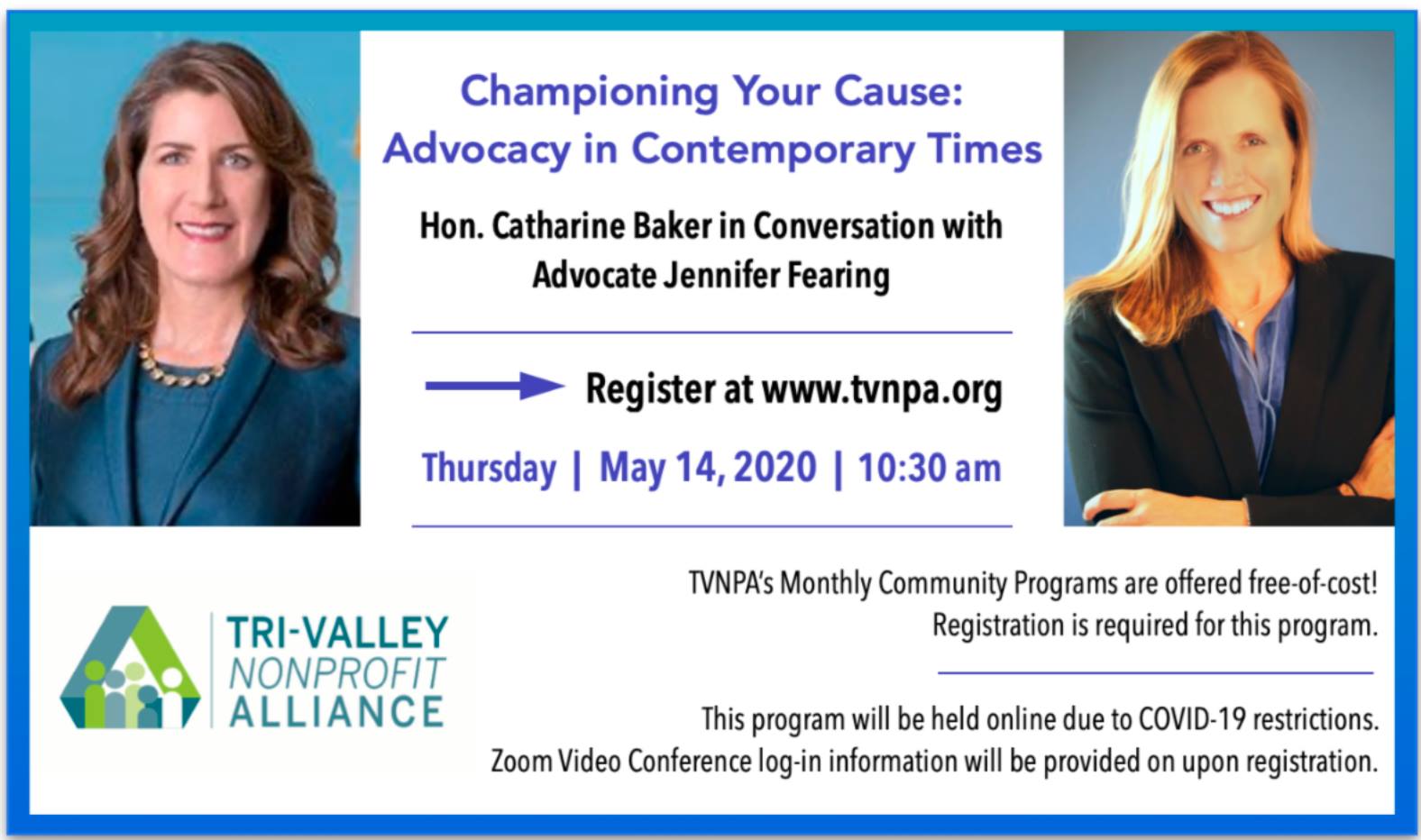

Advocacy Webinar for Non-Profits and Board Directors – May 14, 2020 with Hon. Catharine B. Baker

Tri-Valley NonProfit Alliance hosts Hon. Catharine Baker of Hoge Fenton and Jennifer Fearing of Fearless Advocacy for a webinar program that is a must-see for nonprofits and their board directors. They will be discussing best practices for advocating your organization to local and state governments. In this age of challenges presented by COVID-19, nonprofit organizations small and large will need to work to relay the significance of their missions to the people and government entities that matter most to their success. Catharine and Jennifer will explore how to develop deep relationships with key decision makers in the legislature, the executive branch, and local governments.

After the meeting, registered participants will additionally receive a link to Jennifer Fearing’s chapter in the new textbook: “A Practitioner’s Guide to Lobbying and Advocacy in California,” published by Kendall-Hunt.

Date: May 14, 2020

Time: 10:30am-12pm

About our Speakers:

|

Hon. Catharine Baker is currently Special Counsel at Hoge Fenton Law in Pleasanton, California. Catharine was a Member of the California State Assembly for the 16th District from 2014 – 2018. During her legislative tenure, Catharine developed a reputation as an independent, bipartisan voice in the CA Legislature, fostering collaboration that led to breakthroughs in significant legislation, particularly on transportation, the environment, and government accountability. |

|

Jennifer Fearing is President of Fearless Advocacy, based in Sacramento, California. Jennifer has led efforts to recruit and activate citizen advocates, developed a new legislative caucus, prepared multiple voter scorecards, produced myriad lobby days, and helped with the formation of a new Assembly select committee on the nonprofit sector. Jennifer authored a chapter on nonprofit lobbying included in a new textbook entitled “A Practitioner’s Guide to Lobbying and Advocacy in California.” |

04.24.2020 | Firm Post

|

|

|

| Sarju Naran Hoge Fenton Shareholder/Chair Employment Law +1.408.947.2456 email here |

Steve Tessler California Bank of Commerce Executive VP +1.510.499.9509 email here |

Jenn Protas Hoge Fenton Shareholder Employment Law +1.408.947.2435 email here |

|

|

| Ray Scheaffer, CPA Abbott, Stringham & Lynch Principal +1.408.377.8700 email here |

Darlene Chiang Hoge Fenton Of Counsel Corporate & Bus Law +1.925.460.3367 email here |

04.24.2020 | Firm Post

COVID-19 Federal Aid Alternatives to PPP and EIDL

Although Congress passed another round of funding this week for the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDLs), due to unprecedented need these programs will likely reach their capacity within a few weeks, if not days. There are, however, alternatives to the PPP and EIDL that are important to highlight.

Main Street Lending Program

The Federal Reserve (the “Fed”) established the Main Street Lending Program (the “Program”) to support lending to small and medium-sized businesses that were in good financial standing before the COVID-19 pandemic. The program operates through two arms: the Main Street New Loan Facility and the Main Street Expanded Loan Facility. While the Main Street Lending Facility process remains undefined, the following information is known about it :

- This program is offering loans of as little as $1 million and as much as $150 million to businesses with up to 10,000 employees or $2.5 billion in 2019 revenue.

- This is a $600 billion program.

- The Fed is expected to release additional guidance on the loan application and bank underwriting requirements shortly.

- Banks are not yet able to take applications.

Other Alternatives to the PPP and EIDL:

Here are two alternatives to the PPP and EIDL that may provide some assistance:

- The Employee Retention Credit (“ERC”)

- The ERC provides a refundable payroll tax credit for 50% of the wages paid by employers during the COVID-19 pandemic up to $5,000 per employee per quarter. This credit is applied to the employer’s quarterly tax liability reported on Form 941.

- An employer who receives a loan under the Paycheck Protection Program is ineligible for the ERC.

- Eligible employers must fall into one of two categories:

- The employer’s business is fully or partially suspended by government order due to COVID-19 during the calendar quarter (a “COVID-19 Related Closure”).

- The employer’s gross receipts are below 50% of the comparable quarter in 2019. Once the employer’s gross receipts go above 80% of a comparable quarter in 2019, they no longer qualify after the end of that quarter (a “COVID-19 Impact”).

- The ERC provides a refundable payroll tax credit for 50% of the wages paid by employers during the COVID-19 pandemic up to $5,000 per employee per quarter. This credit is applied to the employer’s quarterly tax liability reported on Form 941.

- The tax credit is provided for the first $10,000 of compensation paid to an employee and is based on qualified wages paid.

- For employers with more than 100 employees, “qualified wages” are all wages paid to only those employees who are being paid not to work. If employers with 100 or fewer employees, the credit is based on wages paid to all employees, regardless if they worked or not. If the employees worked full time and were paid for full time work, the employer still receives the credit.

- “Qualified wages” also include the employer’s contribution to health-insurance costs (subject to the cap of $10,000) but exclude any amounts already received as tax credit.

- No application is required for the ERC. Eligible employers simply claim a payroll credit against its 6.2% of Social Security tax equal to 50% of the qualified wages it paid during the applicable quarter.

- The refundable ERC is reported on the eligible employer’s return beginning in the second quarter for reporting its liability for Federal Insurance Contributions Act (“FICA”) and Railroad Retirement Tax Act, as applicable. For FICA tax purposes, the quarterly Form 941 is used for reporting for most employers.

- The Internal Revenue Service (“IRS”) does not require a business to wait until it files its payroll tax return to claim the ERC. Instead, eligible employers can be immediately reimbursed for the credit by reducing their required deposits of payroll taxes that have been withheld from employees’ wages by the amount of the credit. If the eligible employer’s employment tax deposits are not sufficient to cover the credit, the employer may receive an advance payment from the IRS by submitting Form 7200, Advance Payment of Employer Credits Due to COVID-19.

- The credit is claimed on a quarterly basis and is applicable to wages paid between March 13, 2020, and December 31, 2020, for any quarter the business suffered a COVID-19 Related Closure or a COVID-19 Impact.

- Employer Payroll Tax Deferral

- Employers can defer without penalty the deposit and payment of applicable employment taxes due for the rest of year.

- Fifty percent (50%) of the deferred taxes must be repaid by December 31, 2021, with the remaining due by December 31, 2022.

- “Applicable employment taxes” include the employer’s portion of the social security tax that would otherwise be required to be made from March 27 until December 31, 2020.

- Employers who receive a loan under the Paycheck Protection Program are not eligible for this payroll tax deferral once their loan is forgiven.

- Except for the limitation for employers who receive a loan under the Paycheck Protection Program, all employers are eligible for the payroll tax deferral.

If you have any questions about how these provisions of the CARES Act may apply to your business, please contact Hoge Fenton’s COVID-19 Rapid Response Team.

|

|

|

| Embert Madison, Jr.

Attorney Corporate & Bus Law +1.925.460.3370 |

Darlene Chiang

Of Counsel Corporate & Bus Law +1.925.460.3367 |

Sarju Naran

Shareholder/Chair Employment Law +1.408.947.2456 |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

04.16.2020 | Speaking Engagements & Firm Events

Join our trusted advisors at California Bank of Commerce, Abbott Stringham & Lynch CPAs, and Hoge Fenton as they provide a “Situation Room” update and answer your questions about COVID-19 funding and employment law issues.

In this exclusive complimentary webinar, our panel will discuss:

- The current status of PPP, EIDL, and other government loan programs

- Updates on federal, state, and local guidance for managing employee furloughs, FFCRA paid leave, and unemployment insurance benefits

- Tax strategies and implications of government programs

Meet our Trusted Advisors:

|

|

|

| Sarju Naran Hoge Fenton Shareholder/Chair Employment Law +1.408.947.2456 email here |

Steve Tessler California Bank of Commerce Executive VP +1.510.499.9509 email here |

Jenn Protas Hoge Fenton Shareholder Employment Law +1.408.947.2435 email here |

|

|

| Ray Scheaffer, CPA Abbott, Stringham & Lynch Principal +1.408.377.8700 email here |

Darlene Chiang Hoge Fenton Of Counsel Corporate & Bus Law +1.925.460.3367 email here |

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

04.09.2020 | Firm Post

Thank you to everyone who joined us for our Families First Coronavirus Response Act (“FFCRA”) Leave and the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) Webinar last Tuesday.

Please find the recording of the webinar below.

We hope you found the discussion helpful. Please reach out to our advisors below if you need more guidance and visit our COVID-19 Resources page for additional support.

Our Trusted Silicon Valley Advisors

|

|

|

|

Chair/Shareholder

Employment Law

+1.408.947.2456

|

Shareholder

Employment Law

+1.408.947.2435

|

Of Counsel

Corporate & Business Law

+1.925.460.3367

|

This information is provided as an educational service by Hoge Fenton for clients and friends of the firm. This communique is an overview only, and should not be construed as legal advice or advice to take any specific action. Please be sure to consult a knowledgeable professional with assistance with your particular legal issue. © 2020 Hoge Fenton

04.09.2020 | Firm Post